Banking sector in Nepal is known to adapt the fastest with the changing technological advancement. Our banking sector has played a major role in adapting newer technologies, international banking practices. Banking sector is considered as a medium that helps the citizens of a nation to enhance and uplift the living standard by providing funds, credit facilities, promoting saving and be a part of national economy. On the same conquest some of our commercial level banks has came up with credit facility which can be availed via mobile banking.

Before getting enrolled into FoneLone You need to meet below mentioned criteria to be able to use this service.

- Must have a savings account maintained in the bank with regular transactions.

- Must be a registered user of Laxmi Bank Mobile Money

- Amount of loan is determined automatically by Decision Analytics Software based on the account and transaction history of the customer

- You will be able to know if you are eligible for the Smart FoneLoan in the app itself.

Currently NABIL Bank, Kumar Bank and Laxmi Bank are providing FoneLoan.

Benefits of using FoanLoan:

- Contact Less Digital Lending Experience: Entire lending process happens

through mobile banking; No bank visit, No paper work, no hassle of conventional

credit application process. - Instant (pre-approved) Loan: All process of loan application, approval and

disbursement done instantly at real time, within few minutes. - Collateral Free Loan: Lending based on analytical study of customer’s banking

transactions, no collateral required - Micro Loans: Can apply even for small loan amounts, up to 1 lakh.

How to apply for Laxmi Bank Smart FoneLoan ?

Currently Laxmi Bank is offering this service exclusively to individual customers who have

payroll/ savings account in Laxmi Bank who also meet other criteria defined in the

analytic software.

Step -1 – Log into Mobile Money and all eligible accounts will display Smart FoneLoan icon on the dashboard of the app. Tap on the register button.

Step -2 – After clicking register it will display your account details on the screen. On the bottom of the page enter you email id and click register. and email will be sent to you previously entered mail address open the mail and verify it.

Step -3 – After verification of mail. Go to dashboard and click on the apply for short-term loan button to apply. After that enter the desired amount that you wish (Up to 2 Lakhs) and enter the payback time (1 – 30 days). now click on Check for eligibility, if you are eligible for your desired loan amount than a message will pop, click on I agree and click proceed.

Step -4 – Now you will receive a message with 4 digit CVV no on your mobile. enter it and click confirm.

Step -5 – Congratulations !, Now your loan amount will be deposited on your account by deducting the loan processing fees. You can also download the loan agreement form for future reference. You can check the status of the loan by going to dashboard and clicking on FoneLoan icon.

How FoneLoan Works ?

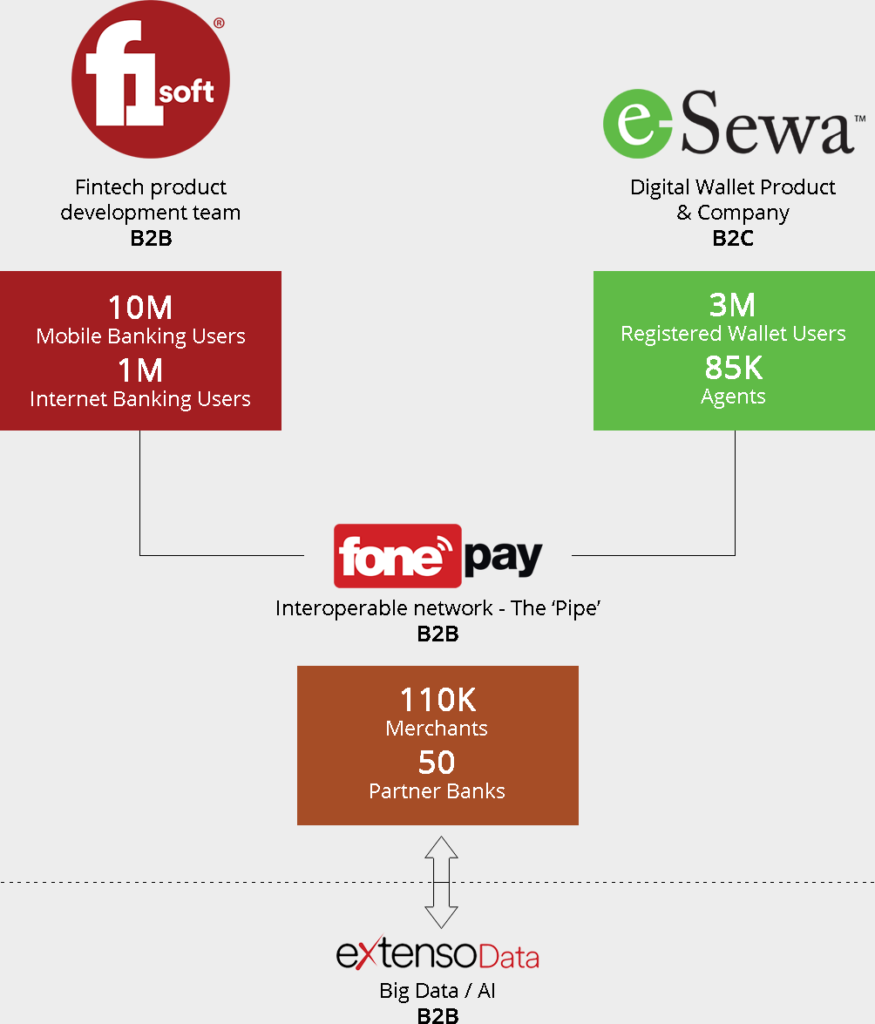

First of all you need to know that there are four entities involved in making this happen Bank, F1 Soft, FonePay and eXtensoData. Here FonePay and eXtensoData are subsidiaries of F1 Soft the same company that owns eSewa.

What happens here is majority of Commercial and Development has partnered with F1 Soft to develop their Mobile Banking apps of their bank. So, we can see majority of the banks UI (User interface) matches. The developed mobile banking app is linked through FonePay which in B2B inter bank network, it channelizes and executes the payment request received form the mobile banking. The transection ends here for regular mobile banking transections.

What happens here is majority of Commercial and Development has partnered with F1 Soft to develop their Mobile Banking apps of their bank. So, we can see majority of the banks UI (User interface) matches. The developed mobile banking app is linked through FonePay which in B2B inter bank network, it channelizes and executes the payment request received form the mobile banking. The transection ends here for regular mobile banking transections.

For FoanLoan, FonePay redirects the request to eXtensoData which specializes in big data and AI and helps analyze the data processed by the ecosystem. Here all the clients behavior related to banking transections are recorded and analyses with the help of AI and Machine Learning which banks like to call Decision Analytics Software. After the data has been studied it allocates the fund that can be provided as FoneLoan to the client. Than it redirects the data to FonePay and Fonepay to mainframe of Bank and finally bank allocates certain loan to the client.

See there’s a lot going on behind a simple click that we made.

Let us know if you have any further query.